Credit scores and much more - Intuit Credit Karma

Intuit Credit Karma offers free credit scores, reports and insights. Get the info you need to take control of your credit.

What is a Good Credit Score? - Intuit Credit Karma

Oct 17, 2025 · What’s a good credit score? Let’s unpack it. Building strong credit starts with understanding it. Credit Karma is here to make the process easier with tips, tools and insights.

Log in - Free Credit Score & Free Credit Reports With Monitoring ...

Get your free credit score and credit report without any hidden fees. No credit card is ever required.

How to improve your credit score - Intuit Credit Karma

Dec 19, 2025 · Learn how to improve your credit scores with practical steps like paying bills on time, keeping balances low, and checking your credit reports for errors.

Free Credit Scores: Check and Monitor | Intuit Credit Karma

Aug 27, 2025 · Check and monitor your free credit scores on Credit Karma with credit scores from Equifax and Transunion. No credit card required.

Check Your Free Credit Reports | Intuit Credit Karma

Sep 22, 2025 · Check your free credit reports from Equifax and TransUnion on Credit Karma. No credit card needed.

How To Check Your FICO Scores For Free | Intuit Credit Karma

Sep 12, 2025 · Knowing your credit scores can help you keep track of your financial progress. Learn how to check FICO scores for free.

What are the three credit bureaus? - Intuit Credit Karma

Sep 12, 2025 · Credit Karma isn’t a credit bureau, but you can see and monitor your credit reports and VantageScore 3.0 credit scores for free from two of the bureaus — Equifax and TransUnion.

Medical bills on credit report: Do they affect your credit?

Feb 20, 2025 · Unpaid medical bills of at least $500 can show up on credit reports. Learn more about their impact on your credit scores.

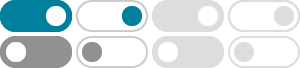

Credit Score Ranges Explained | Intuit Credit Karma

May 12, 2025 · Knowing which credit score range you fall into can help you make financial decisions and prevent you from hurting your credit scores. Learn more.